United Arab Emirates is one of the fastest developing economies in the world. It currently holds the place of the second largest economy in the Arab world. UAE is not the same it was 20 years ago. Back then 90% of UAE’s revenue was was from Oil. Even today most of its revenue comes from oil especially emirates like Abu Dhabi. But Dubai decided to diversify. Dubai has been doing extremely well economically from non-petroleum sectors. Lately Dubai has been giving a lot of attention to infrastructure to attract tourism. From the tallest building to eco-friendly and driver-less cars, Dubai has been technologically advancing at an incredible pace.

One of biggest things UAE is looking forward now is the World Expo 2020, which Dubai says will be the best Expos in the history of Expos in the past 150 years.

But creating the best Expo in history doesn’t happen just like that. Dubai has been known for staying ahead of the competition.

Dubai has been working on a number projects currently to promote and obtain sustainability. Some of them are :

Mohammad Bin Rashid Al Maktoum Solar Park : So as to promote solar energy, this park will be installed at Al Maktoum International Airport .This would limit the hub’s carbon footprint and help to power other places in the emirate.

Dubai Canal Project : A Venice-like canal project that cost an enormous AED150 million (£27.7 million) which would run through the heart of Dubai.

The Impact of all this on Dubai’s economy

With all the Money coming in and all the expenses happening, I think it is likely to attract substantial foreign investment to Dubai. Moreover, it may promote the other regions of UAE to work harder and invest into infrastructure like Dubai for more potential economic growth. All this would strengthen the emirate’s core economic sectors, including financial services, construction, hospitality and tourism.

When taken into account the total estimated spend by the government, participants, visitors and general commercial activity related to the event figures state that there has been an average increase of 6.4 per cent per year in economic growth and at this rate, it is expected to rise up to 10.4 per cent by 2020.

By the analysis of Jones Day, a analyst, the event is likely to generate around $23 billion (£14.8 billion) for the emirate, equating to around 24.4 per cent of Dubai’s current gross domestic product between 2015 and 2021.

In my opinion, Dubai is doing extremely well in terms of preparation for the World Expo 2020 and this event will hopefully bring really good economic growth to Dubai.

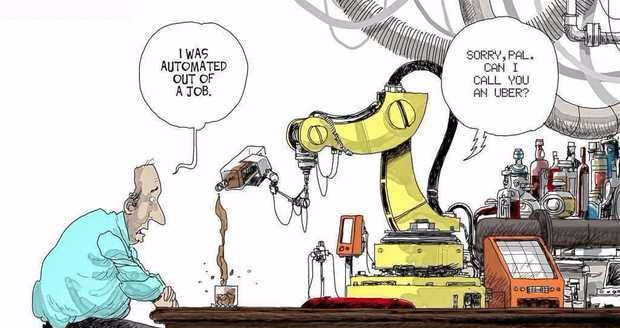

with various economist believing that shadow economy is now the worlds second largest economy.

with various economist believing that shadow economy is now the worlds second largest economy.